Boston, Massachusetts. (October 20, 2017) THC Technologies Corp a private corporation engaged in the global biometric solutions market releases its Current & Projected Global Market for Voice/Speech Recognition Technology Survey.

Boston, Massachusetts. (October 20, 2017) THC Technologies Corp a private corporation engaged in the global biometric solutions market releases its Current & Projected Global Market for Voice/Speech Recognition Technology Survey.

THC CEO Frances Lynch said, " Our Survey prepared for us by outside consultants draws on publicly available information on; voice/speech recognition technology’s industry verticals, market trends, as well as past, present and projected revenues. THC is the obvious choice for our Partners and clients as they address the new security communication challenges and trends discussed in our survey. Our advanced security products in combination with our Partner’s expertise offer innovative technologies positioning us to capitalize on the voice verification and password reset market opportunities worldwide examined in detail in our Survey available below.”

Voice/speech recognition technology identifies people based on the differences in their voice/speech resulting from physiological differences and learned speaking habits. It can be used for both identification and verification of a person. The technology exhibits excellent accuracy for short audios; and is one of the best options for interactive voice response. Automatic voice recognition and text-to-speech software can work together to voice-enable many applications. The technology is used by many companies seeking a competitive edge to help them grow their customer base since it is considered to be non-invasive by customers.

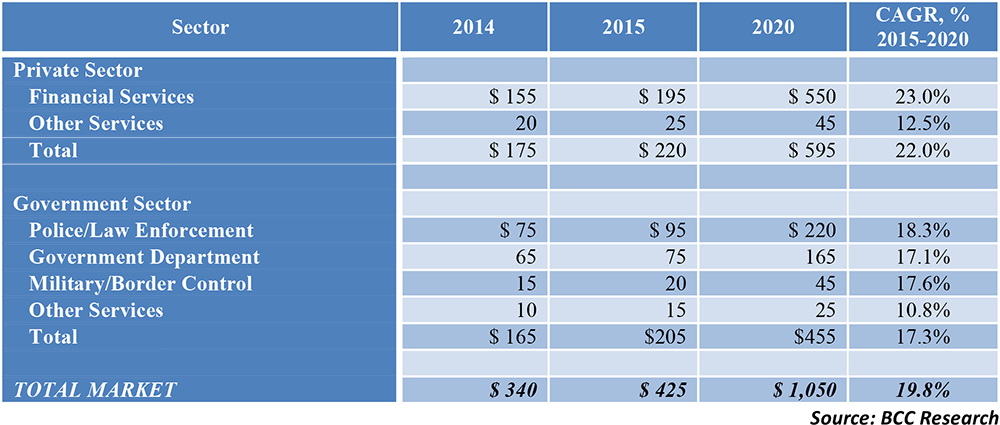

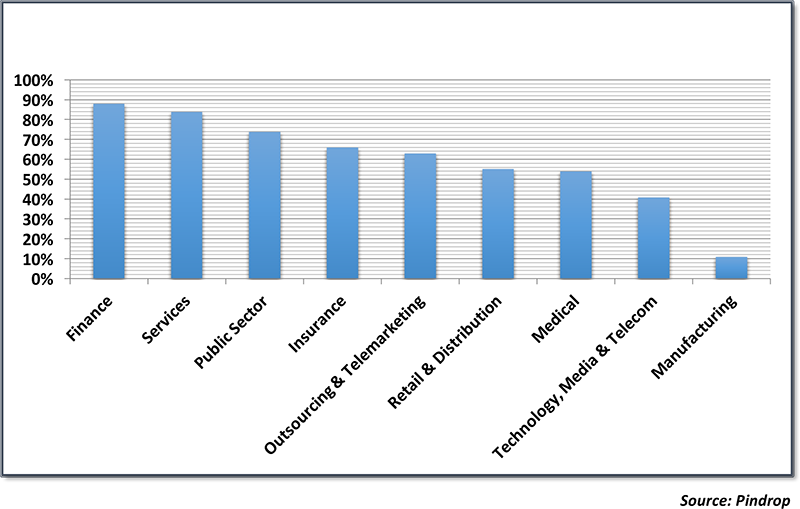

Over the past decade, the use of voice/speech recognition technology to identify people has become a real-world application, considered by companies globally as a powerful fraud prevention tool; and, just as important, as a way to improve relationships with their customers. Banks and financial institutions have been the major markets for this technology to date; and this is expected to continue through 2020 as the total voice/speech recognition technology market grows to over $1.1 billion, as shown in the table below. They use the technology in contact centers, eliminating the need for a person to respond to most customer inquiries. Financial institutions also have the highest portion of calls requiring caller identification, as shown in the figure below, making the deployment of voice biometrics very productive. Its use in mobile applications could provide an easier and more intuitive experience in those applications as well.

Global Market for Voice/Speech Recognition Technology, $ Millions

Proportion of Calls Requiring Caller Identification by Vertical Market

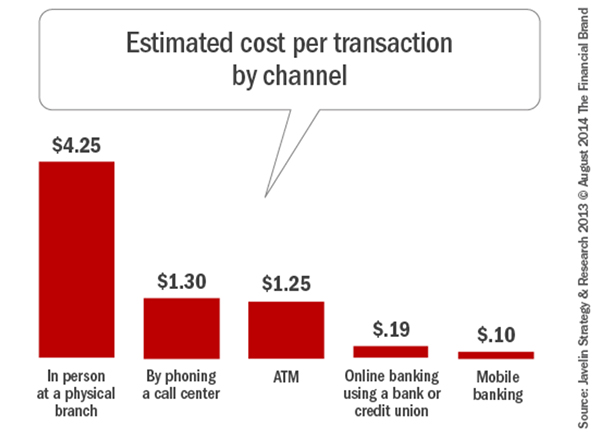

Another reason voice/speech technology has been adopted by financial institutions to verify customer identity is the cost per transaction. As shown in the figure below, it is the least expensive option.

As stated above, fingerprint technology to date has been the chosen method for determining a person’s identity in mobile applications. But, smartphones use only a partial fingerprint. Researchers at New York University and Michigan State University have shown through computer simulations that artificial “Master Prints” can be made that match real prints as much as 65% of the time. Other biometrics technologies, such as voice/speech recognition, do not have this problem. This could lead to major applications of voice/speech recognition technologies that are not included in the projections above.

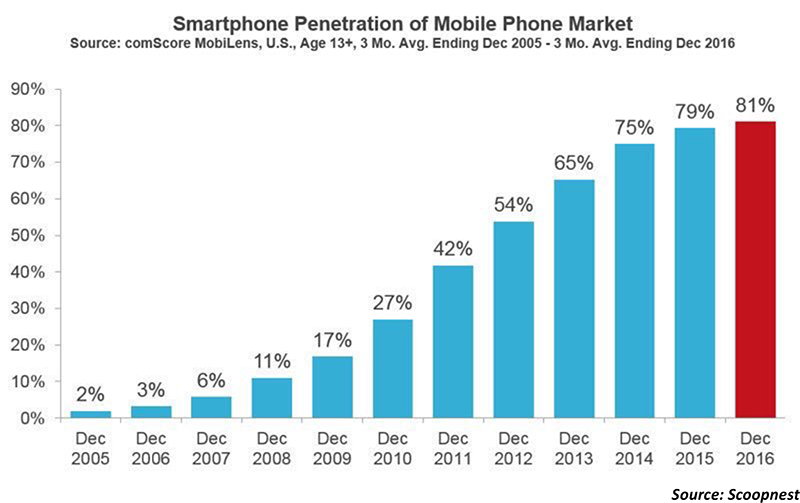

The Rise of Mobile Biometrics Applications

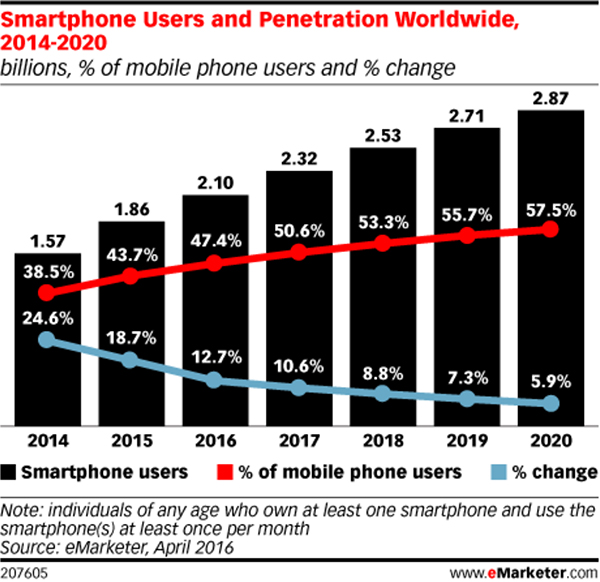

As shown in the figures below, smartphone penetration in the US now exceeds 80%; and global penetration is expected to exceed 55% by 2020. In response, the mobile segment of the biometrics technologies applications market is projected to increase from 20% (in 2014) to 34% by 2020.

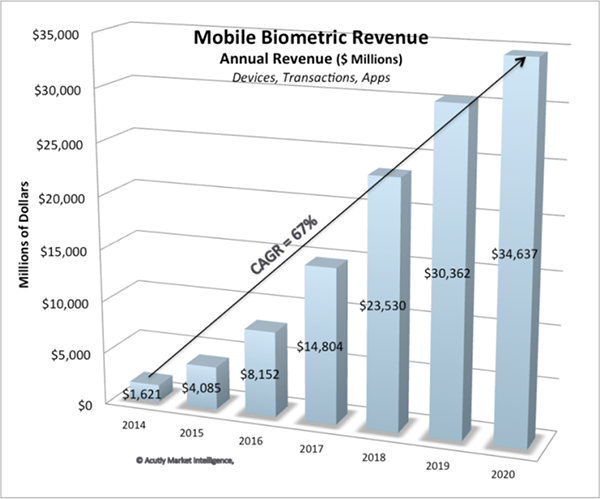

The leading information technology research and advisory firm Gartner has stated that 30% of organizations used biometric authentication on mobile devices by the end of 2016; and Acuity Market Intelligence has projected annual global mobile biometrics market revenues will reach $34.6 billion by 2020. Thus, mobile applications offer a huge potential market for biometrics technologies. Voice/speech recognition technology has the potential to be a winner in this market, as discussed above.

There are five distinct applications for biometrics technologies within this market:

- Payments: mobile wallets Apple Pay and Samsung Pay both currently use fingerprint technology

- Banking: as transactions carry a higher risk than payments, they require stronger authentication; systems for this segment are being developed that provide a balance between convenience and security

- Physical Access Control: providing the ability to open locked doors

- Law Enforcement: mobile biometrics to date have focused on facial and fingerprint technologies

- Disaster Response: used for victim identification and a proper assessment of damage

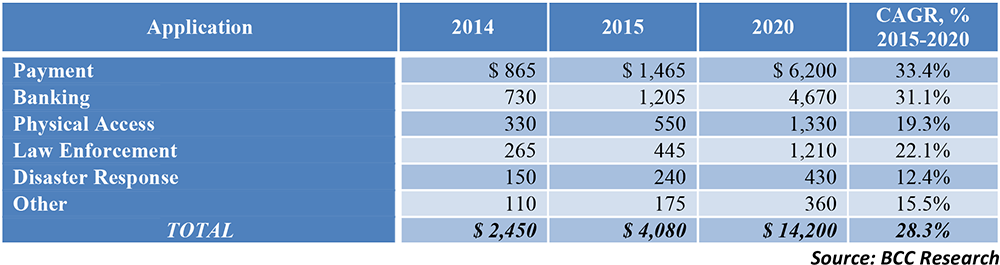

As shown in the table below, payment and banking are projected to be the biggest segments within the mobile applications market by 2020. This provides an opportunity for voice biometrics technologies assuming the perceived – but no longer true - limitations of the technology are addressed.

Global Market for Mobile Biometrics

Status of Voice Biometrics Implementations in Banking, Financial Services and Insurance Sector

Within the Banking, Financial Services and Insurance Sector biometrics are being mainly used to address security concerns. When compared with traditional banking mechanisms, the adoption of biometrics technologies offers many benefits including operational simplicity, time efficiency, elimination of password management, fast and secure online banking, and, most importantly, heightened customer convenience and satisfaction. It is estimated that, by 2020, biometrics will become the predominant identity authorization method for accessing banking and other financial services.

Companies in North America that have or will introduce biometrics technologies in the near term to identify customers include:

- United States Automobile Association

- Key Bank NA, Buffalo, NY

- Belvoir Federal Credit Union

- BMO Harris Bank

- Citizens Bank

- Canadian Bank Tangerine

- RBC

- MasterCard, Visa & American Express

- Webster Bank

- Coppel Corp, Mexico

- Banco Santander Mexico

- Saskatchewan Government Insurance

- Wells Fargo

- Clear Lake Bank & trust, Iowa

- Barclays

- Atom

- New Frontier Group

- SOSB Corp

- First Bank (Virginia, North Carolina & South Carolina)

- SunTrust Bank

- Workers Credit Union

- Mountain America Credit Union

- Service 1st Federal Credit Union

Similar implementations have or are occurring throughout the world.

In conclusion, THC is the obvious choice for our Partners and clients as they address new security communication challenges. Our advanced security products in combination with our Partner’s expertise offer innovative technologies positioning us to capitalize on the substantial market opportunities worldwide.

Organizations in public education, financial services, healthcare, government and many other industries, maximize performance and provide investment protection because THC and our partners deliver complete best-of-breed voice authentication solutions. We focus on designing, developing and deploying voice solutions with our partners sharing the common goal to create best-of-breed hardware and software configurations on which to deploy their industry specific solutions.

Safe Harbor Statement

As provided by the “Safe Harbor Statement under the Private Security Litigation Reform Act of 1995,” THC Technologies Corporation (THC) cautions the reader that this release includes certain information that may constitute forward-looking statements. Actual events or results may differ materially from those projected in the forward-looking statements.